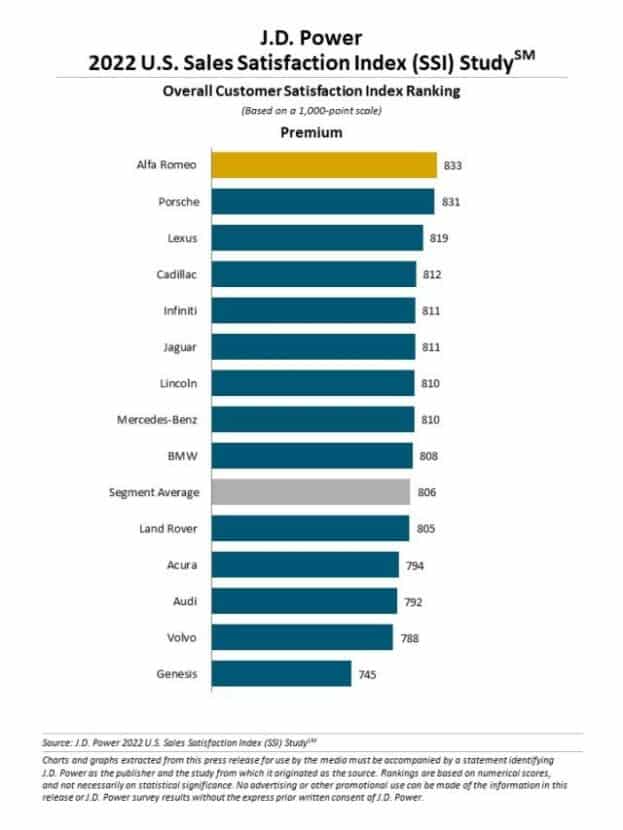

The J.D. Power 2022 U.S. Sales Satisfaction Index (SSI) Study is out and it shows owners are generally less happy with their vehicles compared to last year. The overall sales satisfaction has dropped from 789 to 786 points in this interval, out of a total of 1,000 points. There’s a big surprise among owners of luxury cars as Alfa Romeo has topped the rankings with 833 points, followed closely by Porsche with 831. The last place on the podium is occupied by Toyota’s premium division Lexus with 819 points.

So, how did BMW fare? To put it in one word – average. The Munich-based marque received 808 points or just two points more than the segment average. It did manage to beat Acura (794), Audi (792), Volvo (788), and Genesis (745), but trailed behind Mercedes (810). Cadillac, Infiniti, Jaguar, and Lincoln were also ahead of the Bavarians in the rankings.

In its 37th year, the latest study is based on responses from 36,879 buyers who acquired or leased their cars in the March through May 2022 interval. Satisfaction is quantified based on six factors, listed based on importance: delivery process (26%); dealer personnel (24%); working out the deal (19%); paperwork completion (18%); dealership facility (10%); and dealership website (4%). Rejecter satisfaction is based on five factors: salesperson (40%); price (23%); facility (14%); variety of inventory (11%); and negotiation (11%).

J.D. Power conducted the analysis for 2022 from July through September, examining the following:

- Influential reasons for visiting and purchasing from selling dealer;

- Digital retailing behaviors, interactions, and associated satisfaction;

- Shopping behavior including email, text, phone, and chat;

- Time spent at dealership during the purchase process;

- Key salesperson and dealer staff performance metrics;

- Vehicle delivery performance, including salesperson’s explanation of vehicle features;

- Dealership and brand advocacy measures and future brand and dealer repurchase intentions;

- Reasons for rejecting other dealerships shopped.

Key findings from the 2022 study worth pointing include:

- Sticker price is a demarcation point for new-vehicle buyers;

- EV buyers generally have less satisfying sales experiences than those of ICE cars;

- Special orders may be a solution to sales satisfaction;

- EV buyers could use some show and tell;

- Dealership visits decrease as buyers become more satisfied with digital retailing.

Source: J.D. Power